Written by Laura Heil and Virginia Waters

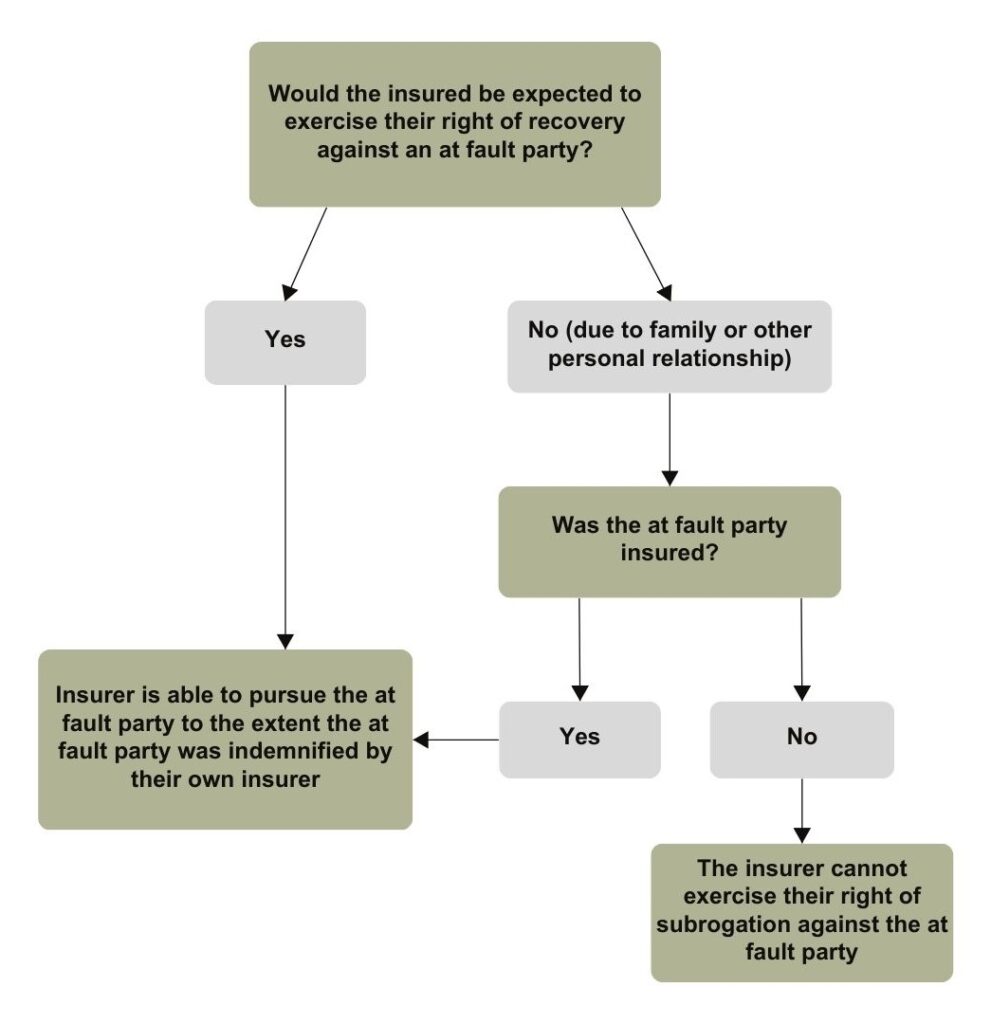

Insurers have a right of subrogation, which enables them to ‘stand in the shoes’ of their insureds to recover from an at fault party. However, sometimes the person who damaged an insured’s vehicle is a family member, friend or employee of the insured and the insured would not ordinarily pursue recovery from that person themselves.

So, what happens here? Section 65 of the Insurance Contracts Act prevents an insurer from exercising their right of subrogation if the at fault person has a ‘family or other personal relationship’ with the insured, unless:

- the conduct occurred during the at fault party’s employment by the insured (see s.66 for more regarding an employment relationship); or

- the conduct of the at fault party was serious or wilful misconduct; or

- most commonly, if the at fault party was insured themselves, to the extent they are indemnified/covered by their own insurer (i.e. if there is any gap, the insurer cannot recover that difference from the at fault party directly).

Below is a flow chart depicting this common scenario which may assist when reviewing claims for recovery.

If you would like to discuss section 65 or 66 of the Insurance Contracts Act, or the right of subrogation generally, please contact any member of the Ligeti Partners team on 03 9947 4500.